Despite the image I’ve used to draw your attention, this is not an attempt to make you picture me as a superhero in a cape or a warrior in gladiatorial armour but it’s relevance will become clear as I explore the need for better storytelling in client communications. I’ve touched upon it before – better communications with your clients leads to better relationships, and subsequently loyalty, growth, and success, so getting it right should be right up there in your list of priorities.

First, there’s a conceptual argument to be had. Is client reporting just a matter of mandatory information provision, or is there an obligation to really help clients understand the information that’s being conveyed? And, if it’s the latter – which we think it is – how do you ensure that happens when these communications are typically one-way? Well, we think it’s largely down to how good your reporting is.

Investment managers are required to report “adequately”, according to the complexity of the instruments that have been traded or invested. The onus is on the provider to establish that adequacy and any more frequent communication periodicity and also meet the “fair, clear, and not misleading” rules.

But often the investment managers’ commonly accepted approach to not go too far beyond what’s specifically required, the vast majority are also therefore not taking advantage of this prime opportunity for business growth.

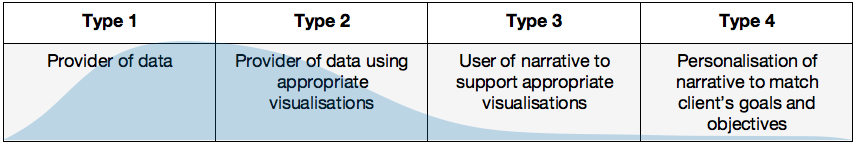

Through our research, we see many examples of client reports and we can confidently categorise their creators into four simple buckets (the table below). Of course, there’s a distribution – something like the shape we’ve applied on top of them – but evolution is slow and Type 4s are seldom seen.

Today, providers should at least be using appropriate visualisations to convey their information – Type 2. Technology exists to enable it, but perhaps there’s a lack of expertise in some reporting functions to understand and really exploit it.

Narrative is rare, and here, I don’t mean supporting commentary and general comments, or an overview regarding the trading environment they operated in, because they’re now quite common. I mean a story that takes the client on the journey of the reporting period, using appropriate visualisations to support it. Personalisation of that narrative is rarer still.

Numerous studies have shown how we absorb information and learn better through storytelling. Stories build connections between people and ideas and unite us with commonality. In a business-to-client relationship, they solidify relationships in a way that facts, numbers and bullet points can’t so using narrative and then personalised narrative in client reporting is a logical progression from where most currently are.

Doing so isn’t easy. You can’t take a known and accepted narrative structure like “The Hero’s Journey” and weave trading activity and investment performance around it like countless coming of age tales have (Harry Potter, Superman, and so forth). But you can build structure. You can have a start, a middle, and an end which can coincide with the reporting period in focus. With the right operational set-up, you can reallocate your time and effort to the creation of the investor story instead of the collection, calculation and correction of data and that’s where we step in to help.

Moving towards such reporting is a leap of faith. You and your management team will probably have some reluctance. You’ll worry about the potential time, cost and effort it will take to change your existing structure and process, and decide that the status quo is worth maintaining denying the benefits that a change will bring. Maybe you haven’t got the right skills, maybe you suspect your clients won’t appreciate it.

It’s not like that though. We can show you another way. We can show you how to automate the processes to give you the time to create the reports your clients really want to see. You’ll increase engagement with them and that’s only going to be a good thing in the long-term. We can show you how the change is incredibly quick too (our last implementation took 5 weeks). We can show you how to reconfigure your operational processes and budget to align effort and spend to the tasks that add the most value to your client relationships and we’ll support you every step of the way when you do so.

Your clients will welcome the change. They’ll be more engaged and better informed. Increased communication will improve the relationship and you’ll grow your business on the back of it. Reporting will no longer be just a mandatory exercise and cost, as it transforms into a revenue generator and your new world will be a lot more productive for everyone involved.

Imagine how much of a hero you’ll be when that happens.