Many investment firms are finding that they are spending more and more time and effort producing client reports, taking time away from client service. This is because the deadlines are getting shorter, the clients’ reporting requirements are getting more demanding and there’s more personalisation of the reports required – so they are highly relevant to each individual client.

This linkage between time, effort and report personalisation needs to be broken and replaced with a flexible and automated solution, that allows for increased reporting scale, greater reporting content and complexity, produced quicker while using less resources.

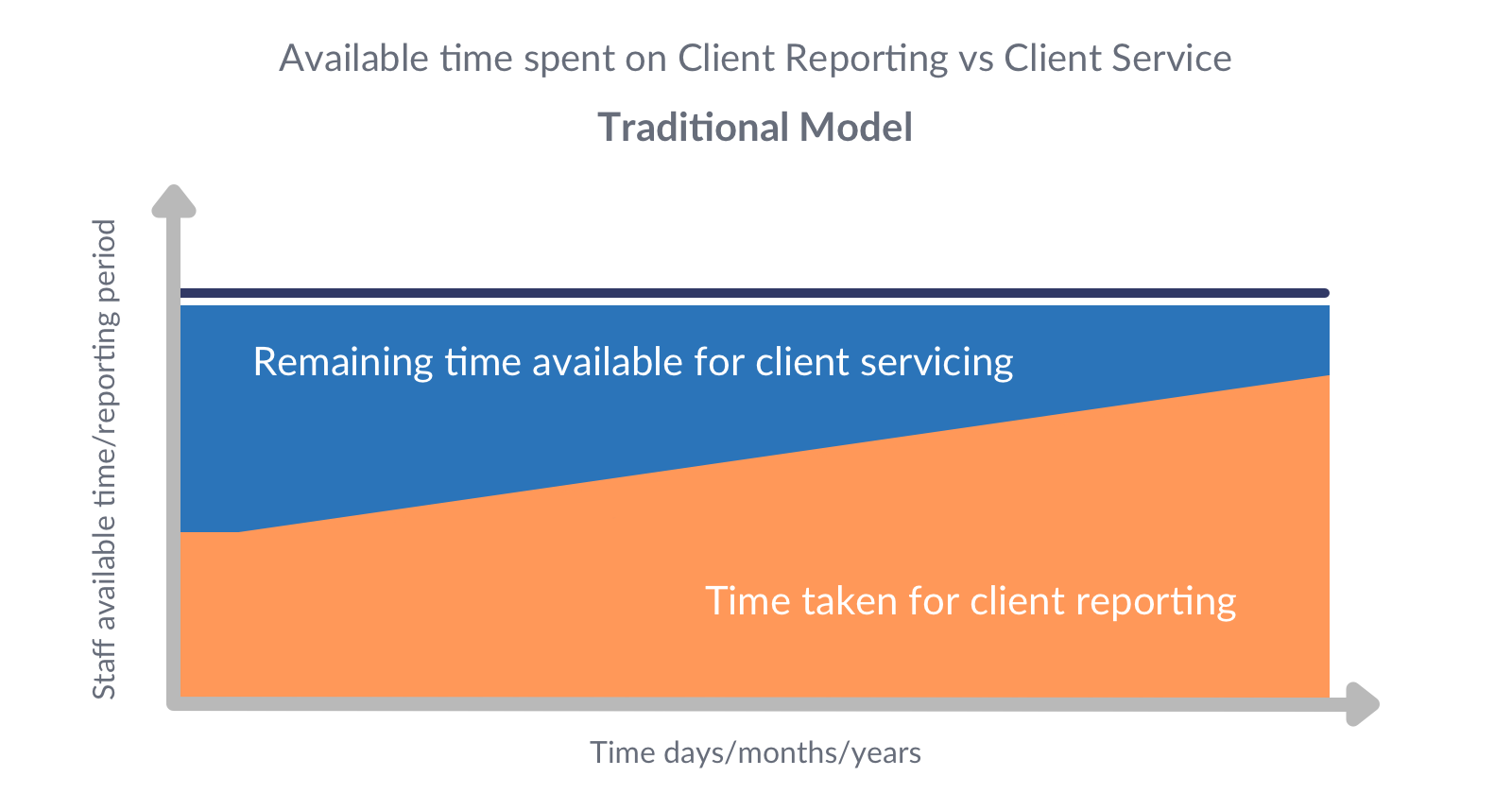

Sounds impossible, well it’s not. Let me explain how, firstly by looking at the reporting team graph of available time and how it is used. In the traditional model, the longer the reporting team spend undertaking client reporting, the less time there is available to service the clients and adding value in other ways.

The traditional model:

The shaded orange area represents the increasing time and effort required to support the increasingly complex and demanding reporting requirements of the clients. Accordingly, the blue area represents the diminishing time available for client servicing in this traditional model. This situation is far from ideal as typically the reporting becomes more and more manual over time, and the quality and levels of client service reduce over time.

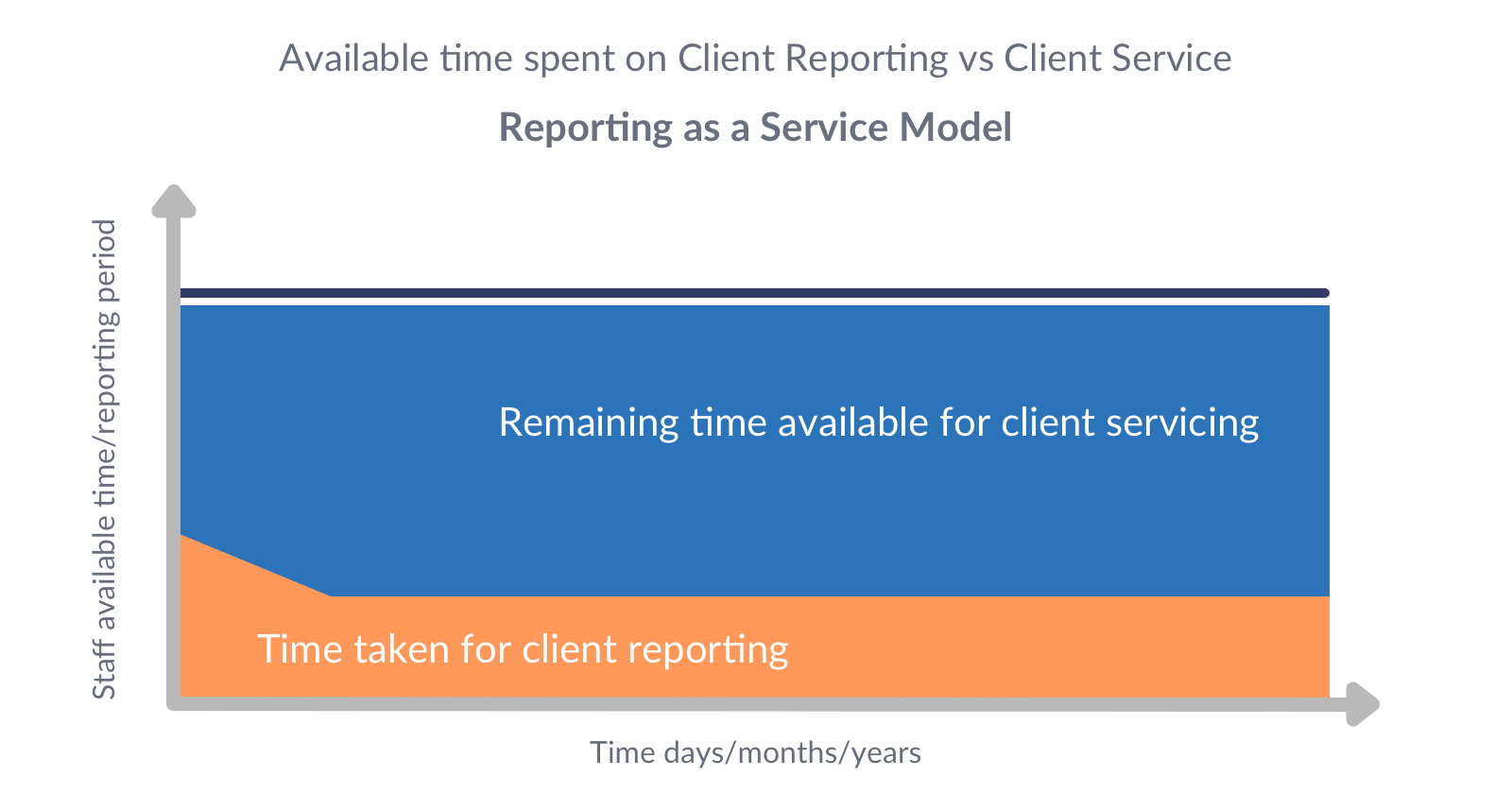

Reporting as a Service model:

With the Reporting as a Service model, the system fully automates the entire end to end process, allowing the reporting team to produce more reports, with more content, more quickly, more accurately and therefore leaving them more time to service their clients. After a short period of bedding down, the effort remains static. No additional effort or resources are required to produce and distribute more reports, more content rich and complex reports or more personalised reports. The reporting team and process becomes insensitive to reporting volumes and can use the greater time available to service clients and add value within the business.

It’s easier, faster, more reliable and less expensive than you might think: Reporting as a Service.

Like all great solutions, our reporting service is simple to understand and use. Your data, your team, our system, your reports.

Reporting as a Service is a cloud-based system that provides investment firms with a complete end to end client and fund reporting solution, that is flexible, scalable and future proof. This allows users to manage and control the entire process and provide reporting of the highest quality to their clients.

To find out more about our solution and how it benefits Wealth and Asset Management firms please visit our website at www.opus-nebula.com and email [email protected] to arrange a meeting and see a live demonstration of the system.

Andrew Sherlock

Opus Nebula